The Power of AI in Financial Services

Artificial Intelligence (AI) is not just a buzzword; it’s a revolutionary force reshaping the financial services sector in ways we never imagined possible. Imagine walking into your bank, and instead of waiting in line, you’re greeted by a virtual assistant that knows your financial history and offers personalized advice. This is the reality of AI in finance, where technology meets human-like intuition to enhance efficiency, improve customer experience, and drive innovation.

As we delve deeper into this topic, it’s essential to recognize that while AI brings incredible advantages, it also poses challenges and ethical considerations that must be addressed. From automating mundane tasks to providing insights that lead to informed decision-making, AI's impact is profound and multifaceted. Financial institutions are leveraging AI to analyze vast amounts of data, allowing them to create tailored solutions for their customers. This transformation is not just about technology; it’s about fostering a new relationship between consumers and financial services that is more engaging and responsive.

So, how exactly is AI transforming the financial sector? Let’s explore the various dimensions of this transformation, starting with AI-driven customer insights. By analyzing customer data, AI systems can provide personalized financial services that enhance customer satisfaction. Imagine receiving a notification on your phone suggesting a savings plan tailored to your spending habits. This is the kind of engagement that AI facilitates, creating a win-win situation for both consumers and financial institutions.

Moreover, AI plays a crucial role in risk management and fraud detection. Financial institutions are increasingly turning to advanced algorithms and predictive analytics to identify potential risks and detect fraudulent activities. By employing machine learning algorithms, these institutions can refine their predictive models, continuously learning and adapting to new data, which leads to enhanced accuracy in financial predictions.

In addition, the importance of real-time monitoring systems cannot be overstated. These systems utilize AI to detect anomalies and respond promptly to emerging risks, ensuring a proactive approach to risk management. The result? A safer, more secure financial environment where trust is maintained, and assets are safeguarded.

As we navigate through the complexities of the financial landscape, it’s crucial to acknowledge the operational efficiencies that AI brings. By automating routine tasks, AI reduces operational costs and allows professionals to focus on strategic decision-making and customer relations. This shift not only enhances productivity but also fosters a more innovative workplace culture.

Another significant aspect of AI in finance is its impact on regulatory compliance. With an ever-evolving regulatory landscape, financial institutions face immense pressure to adhere to complex regulations. AI assists in monitoring transactions and ensuring compliance, minimizing human error in the process. Automated reporting systems powered by AI save time and enhance accuracy, allowing institutions to meet regulatory requirements more efficiently.

However, as we embrace the power of AI, we must also confront the ethical considerations it brings to the forefront. Issues such as data privacy, algorithmic bias, and the need for transparency in AI decision-making processes are critical to maintaining consumer trust. Addressing these challenges is essential for the sustainable growth of AI in financial services.

In conclusion, the power of AI in financial services is undeniable. It’s transforming the way we interact with money, enhancing efficiency, and driving innovation. As we continue to explore this exciting frontier, let’s remain vigilant about the ethical implications and strive for a future where AI serves as a tool for empowerment and trust.

- What is AI's role in financial services? AI enhances customer experience, improves risk management, and automates operational processes.

- How does AI improve customer insights? AI analyzes customer data to provide personalized recommendations, enhancing engagement and satisfaction.

- What are the ethical concerns regarding AI in finance? Key concerns include data privacy, algorithmic bias, and the need for transparency in AI decision-making.

- Can AI help with regulatory compliance? Yes, AI assists in monitoring transactions and automating compliance reporting, reducing human error.

AI-Driven Customer Insights

In today's fast-paced financial world, understanding customer behavior is more crucial than ever. This is where artificial intelligence steps in, turning raw data into actionable insights. Imagine having a crystal ball that not only shows you what your customers want but also predicts their future needs. That's the power of AI in analyzing customer data!

AI algorithms process vast amounts of information, identifying patterns and trends that human analysts might overlook. By leveraging these insights, financial institutions can provide personalized services that resonate with individual customers. For instance, if a bank knows that a customer is saving for a vacation, it can offer tailored savings plans or investment options that align perfectly with that goal. This level of personalization enhances customer satisfaction and builds loyalty, making clients feel valued and understood.

Moreover, AI-driven insights allow financial services to engage customers more effectively. With targeted marketing strategies, institutions can reach out with relevant offers at the right time. Consider this: instead of bombarding customers with generic advertisements, AI helps craft messages that speak directly to their interests. This not only increases the chances of conversion but also fosters a deeper connection between the customer and the brand.

Let’s take a look at a few key benefits of AI in understanding customer insights:

- Enhanced Engagement: Personalized recommendations and timely communications keep customers engaged.

- Improved Customer Experience: Tailored services lead to higher satisfaction rates.

- Data-Driven Decisions: Financial institutions can make informed choices based on accurate predictions.

However, the implementation of AI isn't without its challenges. Financial institutions must ensure that they are collecting data ethically and transparently. Customers are becoming increasingly aware of their data privacy rights, and any misstep could lead to a loss of trust. Therefore, it’s essential for organizations to communicate clearly about how their data is used and to prioritize security.

In conclusion, AI-driven customer insights are revolutionizing the financial sector. By providing personalized experiences and enhancing engagement, AI not only meets customer expectations but also drives innovation within the industry. As we move forward, embracing this technology while navigating its challenges will be key to staying competitive in the financial landscape.

Risk Management and Fraud Detection

In the ever-evolving landscape of finance, the stakes are high, and the risks are numerous. Financial institutions face a myriad of challenges, from market volatility to cyber threats. Enter artificial intelligence (AI), a game-changer in the realm of risk management and fraud detection. By leveraging advanced algorithms and predictive analytics, AI empowers organizations to identify potential risks before they escalate, ensuring a robust defense against fraudulent activities.

Imagine having a vigilant watchtower that scans the horizon for any signs of trouble. That's precisely what AI does for financial institutions. It analyzes vast amounts of data in real-time, detecting anomalies that could indicate fraudulent behavior. For instance, if a customer's spending patterns suddenly shift dramatically, AI can flag this transaction for further investigation. This proactive approach not only protects assets but also maintains the trust that is paramount in the financial sector.

One of the key components of AI in risk management is predictive analytics. This powerful tool allows financial organizations to forecast market trends and assess risks with remarkable accuracy. By analyzing historical data and recognizing patterns, AI can help institutions make informed investment decisions. For example, if AI identifies a recurring trend of economic downturns following a specific set of circumstances, it can alert decision-makers to tread carefully.

Predictive analytics powered by AI is like having a crystal ball that reveals potential future outcomes based on current data. This technology enables financial institutions to anticipate market fluctuations, allowing them to adjust strategies proactively. As a result, organizations can enhance their financial outcomes and avoid costly mistakes. With AI's ability to process data at lightning speed, the insights generated can be both timely and actionable.

At the heart of predictive analytics lies machine learning algorithms. These algorithms continuously learn from new data, refining their predictive models over time. It's akin to a student who learns from past mistakes and improves with each lesson. By adapting to new information, machine learning enhances the accuracy of financial predictions, making it an invaluable tool for risk management.

In addition to predictive capabilities, AI also excels in real-time monitoring. This feature is crucial in a world where threats can emerge within seconds. Financial institutions can deploy AI systems that monitor transactions as they occur, detecting any irregularities that could signify fraud. This immediate response capability ensures that organizations can act swiftly to mitigate risks, preserving both their assets and their reputation.

As financial institutions continue to embrace AI, the landscape of risk management and fraud detection is transforming. The combination of predictive analytics, machine learning, and real-time monitoring creates a robust framework that not only enhances security but also fosters innovation within the sector. However, as with any powerful tool, there are challenges and ethical considerations that need to be addressed to ensure that AI is used responsibly and effectively.

- How does AI detect fraud in real-time? AI analyzes transaction data for unusual patterns and behaviors, allowing for immediate alerts and actions to prevent fraudulent activities.

- What role does predictive analytics play in risk management? Predictive analytics helps organizations anticipate potential market trends and risks, enabling informed decision-making and strategic planning.

- Are there ethical concerns with using AI in finance? Yes, concerns include data privacy, algorithmic bias, and the need for transparency in AI decision-making processes.

Predictive Analytics in Finance

In today's fast-paced financial landscape, predictive analytics is emerging as a game-changer for institutions aiming to stay ahead of the curve. Imagine having the ability to foresee market trends and customer behaviors before they unfold—this is the power that predictive analytics harnesses through advanced algorithms and data analysis. By leveraging vast amounts of historical data, financial organizations can create models that not only predict future outcomes but also inform strategic decision-making. It's akin to having a crystal ball that helps navigate the complex waters of finance, providing insights that were once thought to be out of reach.

At its core, predictive analytics utilizes statistical techniques and machine learning to analyze past behaviors and trends. This allows financial institutions to identify patterns that can lead to significant advantages. For instance, banks can predict the likelihood of a customer defaulting on a loan by examining their past financial behavior, credit history, and even social factors. By doing so, they can tailor their offerings and risk assessments accordingly, thus enhancing overall profitability while minimizing losses. It's a win-win situation that benefits both the institution and the customer.

Moreover, the integration of predictive analytics in finance isn't limited to risk assessment. It extends to areas like investment strategies, where firms can forecast market movements and adjust their portfolios proactively. By analyzing real-time data and historical trends, financial analysts can make informed decisions, optimizing their investment strategies to maximize returns. For example, if predictive models indicate a downturn in a particular sector, firms can swiftly reallocate resources, mitigating potential losses.

To illustrate the impact of predictive analytics, consider the following table that highlights key benefits and applications within the financial sector:

| Application | Benefit |

|---|---|

| Credit Scoring | Improves risk assessment and loan approval processes. |

| Customer Segmentation | Enhances targeted marketing strategies and personalized services. |

| Fraud Detection | Identifies unusual patterns to prevent fraudulent activities. |

| Market Trend Analysis | Informs investment decisions and portfolio adjustments. |

However, while the benefits of predictive analytics are substantial, it is essential to approach its implementation with caution. The accuracy of predictions relies heavily on the quality of data being analyzed. Poor data quality can lead to misleading conclusions, which may result in financial losses rather than gains. Therefore, organizations must invest in robust data management practices to ensure that the insights generated are reliable and actionable.

In conclusion, predictive analytics in finance represents a revolutionary shift in how institutions operate and strategize. By embracing this technology, they can enhance their decision-making processes, improve customer satisfaction, and ultimately drive better financial outcomes. As we continue to navigate the complexities of the financial world, the role of predictive analytics will undoubtedly grow, paving the way for a more data-driven future.

Frequently Asked Questions

- What is predictive analytics?

Predictive analytics is a statistical technique that uses historical data to forecast future outcomes and behaviors. - How does predictive analytics benefit financial institutions?

It helps in risk assessment, customer segmentation, fraud detection, and market trend analysis, enhancing decision-making and profitability. - What are the challenges associated with predictive analytics?

Challenges include data quality, the need for skilled personnel, and the potential for over-reliance on automated systems.

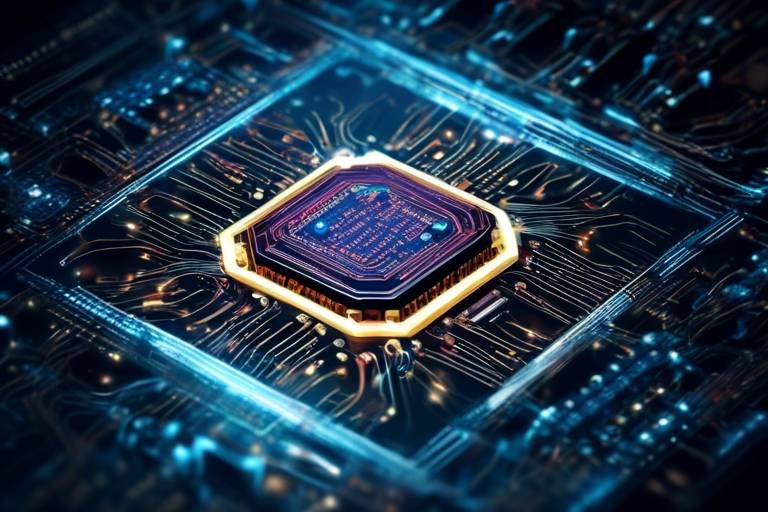

Machine Learning Algorithms

When it comes to the financial sector, are nothing short of revolutionary. Imagine having a super-smart assistant that learns from every interaction, continuously improving its performance. That's what these algorithms do! They analyze vast amounts of data, identify patterns, and adapt to new information, making them invaluable for financial institutions looking to enhance their predictive capabilities.

One of the most exciting aspects of machine learning in finance is its ability to refine predictive models. Traditional methods often rely on static models that can quickly become outdated. In contrast, machine learning algorithms are designed to learn and evolve over time. They can process real-time data and adjust their predictions accordingly, which is crucial in a fast-paced environment like finance. This continuous learning leads to more accurate forecasts and better decision-making.

For instance, consider the way these algorithms assess credit risk. By analyzing an individual's financial history, spending habits, and even social media activity, machine learning can generate a more comprehensive risk profile than traditional methods. This not only helps lenders make informed decisions but also enables them to offer personalized products that suit individual needs. It's like having a financial advisor who knows you inside out!

Additionally, the adaptability of machine learning algorithms means they can respond to new trends and anomalies. For example, if a sudden market change occurs, these algorithms can quickly analyze the situation and adjust their predictions, allowing financial institutions to react proactively rather than reactively. This agility is essential in maintaining a competitive edge in the market.

However, implementing machine learning algorithms is not without its challenges. Financial institutions must ensure they have the right data infrastructure in place to support these advanced technologies. Moreover, the quality of the data used for training these algorithms is crucial. Poor data can lead to inaccurate predictions, which can have serious implications for financial decisions.

In summary, are transforming the financial landscape by enhancing predictive accuracy, improving risk assessment, and enabling institutions to adapt to changing market conditions. As these technologies continue to evolve, they will undoubtedly play a pivotal role in shaping the future of financial services.

- What are machine learning algorithms?

Machine learning algorithms are computational models that learn from data to make predictions or decisions without being explicitly programmed for specific tasks.

- How do machine learning algorithms improve financial services?

They enhance predictive accuracy, automate processes, and allow for personalized services by analyzing large datasets and identifying trends.

- What challenges do financial institutions face when implementing these algorithms?

Key challenges include ensuring data quality, having the right infrastructure, and addressing potential biases in the algorithms.

Real-Time Monitoring

In today's fast-paced financial landscape, the significance of cannot be overstated. Imagine being able to detect a potential threat or opportunity the moment it arises—this is the power that AI brings to the table. Financial institutions are leveraging advanced algorithms and machine learning to create systems that continuously analyze transactions and market movements, allowing them to respond swiftly to any anomalies. This proactive approach is akin to having a vigilant guard watching over your assets, ready to spring into action at the first sign of trouble.

Real-time monitoring systems utilize vast amounts of data from various sources, including transaction histories, market trends, and social media sentiment. By analyzing this data in real time, AI can identify patterns that may indicate fraud or market volatility. For instance, if a customer suddenly makes a series of large withdrawals from their account, the system can flag this activity immediately, prompting an investigation before significant losses occur. This capability not only safeguards the institution's assets but also enhances customer trust—clients feel secure knowing that their financial service provider is actively monitoring their accounts.

Moreover, the integration of AI in real-time monitoring allows for a more nuanced understanding of risk. Traditional methods often rely on static rules and thresholds, which can lead to false positives or negatives. In contrast, AI-driven systems continuously learn from new data, adapting their algorithms to improve accuracy over time. This dynamic learning process is crucial in a world where financial fraud tactics are constantly evolving. For example, a machine learning model might learn that certain transaction patterns are typical for a specific demographic, allowing it to differentiate between legitimate behavior and potential fraud more effectively.

The benefits of real-time monitoring extend beyond just fraud detection. These systems can also provide valuable insights into market trends, enabling financial institutions to make informed decisions quickly. By understanding shifts in consumer behavior or sudden market changes, companies can adjust their strategies in real-time, enhancing their competitive edge. To illustrate this, consider the following table that highlights key aspects of real-time monitoring systems:

| Feature | Description |

|---|---|

| Instant Alerts | Notifies stakeholders of suspicious activities as they occur. |

| Adaptive Learning | Improves accuracy by learning from new data continuously. |

| Comprehensive Data Analysis | Analyzes data from multiple sources for a holistic view of risk. |

| Enhanced Decision-Making | Provides insights that facilitate swift, informed decisions. |

In conclusion, the implementation of real-time monitoring powered by AI is revolutionizing the financial services sector. It not only enhances security and efficiency but also fosters a culture of innovation and adaptability. As financial institutions continue to embrace these advanced technologies, they will be better equipped to navigate the complexities of the modern financial landscape, ultimately leading to improved outcomes for both the organizations and their clients.

- What is real-time monitoring in financial services?

Real-time monitoring refers to the continuous analysis of transactions and market activities to identify potential risks or fraud as they occur. - How does AI improve real-time monitoring?

AI enhances real-time monitoring by analyzing vast amounts of data quickly, adapting to new patterns, and providing instant alerts for suspicious activities. - What are the benefits of using real-time monitoring systems?

Benefits include increased security, reduced fraud, improved decision-making, and enhanced customer trust.

Enhancing Operational Efficiency

In the fast-paced world of finance, where every second counts and precision is paramount, artificial intelligence (AI) emerges as a game-changer, streamlining operations and enhancing efficiency. Imagine a bustling financial institution where countless transactions occur every day; the sheer volume can be overwhelming. However, with the integration of AI, this chaos transforms into a well-orchestrated symphony. AI technologies automate repetitive tasks, thereby reducing the burden on human employees and allowing them to focus on what truly matters: strategic decision-making and fostering customer relationships.

Consider the mundane tasks that consume a significant amount of time in financial services. These can include data entry, transaction processing, and even customer inquiries. By deploying AI-powered chatbots and robotic process automation (RPA), financial institutions can handle these tasks swiftly and accurately. For instance, chatbots can respond to customer queries 24/7, providing instant support and freeing up human agents to tackle more complex issues. This not only enhances customer satisfaction but also boosts employee morale, as they can engage in more meaningful work.

Furthermore, AI can analyze vast amounts of data at lightning speed, identifying patterns and insights that would take humans much longer to uncover. This capability is particularly useful in areas such as portfolio management and investment analysis. By leveraging AI algorithms, financial analysts can receive real-time insights into market trends, enabling them to make informed decisions swiftly. For example, AI can predict stock price movements based on historical data and current market conditions, allowing traders to capitalize on opportunities before they vanish.

To illustrate the impact of AI on operational efficiency, let’s take a closer look at a few key benefits:

- Cost Reduction: Automating routine tasks significantly cuts down operational costs, allowing firms to allocate resources more effectively.

- Increased Accuracy: AI minimizes human error in data processing, leading to more reliable outcomes.

- Faster Decision-Making: With AI analyzing data in real-time, financial institutions can respond to market changes more rapidly than ever before.

Moreover, the implementation of AI in financial services leads to better compliance with regulatory requirements. By automating compliance checks and monitoring transactions, AI helps institutions adhere to complex regulations, reducing the risk of costly penalties. This proactive approach not only safeguards the institution's reputation but also enhances trust among clients.

In conclusion, as financial services continue to evolve, the role of AI in enhancing operational efficiency cannot be overstated. By automating tasks, providing real-time insights, and improving compliance, AI empowers financial institutions to operate more effectively and deliver superior customer experiences. The future of finance is undoubtedly intertwined with the advancements in AI, and organizations that embrace this technology will be well-positioned to thrive in an increasingly competitive landscape.

Q1: How does AI improve customer service in financial institutions?

A1: AI enhances customer service through chatbots that provide instant responses to inquiries, personalized recommendations based on customer data, and efficient handling of routine tasks, allowing human agents to focus on complex issues.

Q2: What are the risks associated with AI in financial services?

A2: Some risks include data privacy concerns, potential algorithmic bias, and the need for transparency in AI decision-making processes to maintain consumer trust.

Q3: Can AI help in fraud detection?

A3: Yes, AI plays a crucial role in identifying fraudulent activities by analyzing transaction patterns and flagging anomalies in real-time, enabling financial institutions to act swiftly and protect their assets.

Regulatory Compliance and AI

The financial sector operates under a complex web of regulations designed to protect consumers and ensure market integrity. As such, regulatory compliance is not just a box to check; it is a vital aspect of any financial institution's operations. With the advent of artificial intelligence (AI), the landscape of compliance is undergoing a significant transformation. AI technologies are proving to be invaluable tools in monitoring transactions, analyzing data patterns, and ensuring adherence to regulations, all while minimizing the potential for human error.

One of the most significant advantages of AI in regulatory compliance is its ability to process vast amounts of data at incredible speeds. Traditional compliance methods often involve tedious manual reviews that can be time-consuming and prone to mistakes. In contrast, AI-driven systems can automatically analyze transactions in real-time, flagging any anomalies that may indicate non-compliance or fraudulent activities. This not only enhances the accuracy of compliance efforts but also allows financial institutions to respond promptly to potential issues before they escalate.

Moreover, AI can significantly reduce the burden of compliance reporting. Financial institutions are required to submit numerous reports to regulatory bodies, a task that can be overwhelming and resource-intensive. By employing automated reporting systems, AI helps streamline this process. These systems can generate reports with a high degree of accuracy, ensuring that all necessary information is included and reducing the likelihood of errors that could lead to penalties or reputational damage.

To illustrate the impact of AI on regulatory compliance, consider the following table:

| Traditional Compliance Methods | AI-Driven Compliance Solutions |

|---|---|

| Manual data entry and analysis | Automated data processing and analysis |

| Time-consuming reporting | Instant report generation |

| High potential for human error | Minimized errors through machine learning |

| Limited ability to monitor transactions | Real-time transaction monitoring |

However, while AI offers tremendous benefits, it also raises important questions about data privacy and algorithmic bias. Financial institutions must ensure that the data used in AI models is handled with the utmost care, adhering to privacy regulations such as the General Data Protection Regulation (GDPR). Furthermore, there is a growing need for transparency in how AI systems make decisions, as biased algorithms can perpetuate inequalities and undermine consumer trust. Addressing these ethical considerations is crucial for the successful integration of AI in regulatory compliance.

In conclusion, the intersection of AI and regulatory compliance represents a paradigm shift in how financial institutions operate. By leveraging AI technologies, organizations can enhance their compliance efforts, reduce operational risks, and ultimately build a more trustworthy relationship with their customers. As we move forward, it will be essential to navigate the challenges that accompany these advancements, ensuring that the implementation of AI not only meets regulatory standards but also aligns with ethical practices.

- How does AI improve regulatory compliance in financial services? AI enhances regulatory compliance by automating data analysis, monitoring transactions in real-time, and generating accurate reports, significantly reducing the risk of human error.

- What are the ethical concerns surrounding AI in compliance? Key concerns include data privacy, algorithmic bias, and the need for transparency in AI decision-making processes to maintain consumer trust.

- Can AI completely replace human compliance officers? While AI can automate many aspects of compliance, human oversight is still essential for making complex decisions and addressing ethical considerations.

Automated Reporting Systems

The financial industry is constantly evolving, and with the advent of artificial intelligence, the way institutions handle reporting has undergone a seismic shift. Automated reporting systems powered by AI are revolutionizing the way financial organizations manage compliance and reporting tasks. Imagine a world where tedious manual processes are replaced by intelligent algorithms that not only save time but also enhance accuracy. This is not just a dream; it's the reality of modern finance.

One of the primary benefits of automated reporting systems is their ability to streamline data collection. Traditional reporting often involves sifting through mountains of data, which can be both time-consuming and prone to human error. AI-driven systems can gather and process vast amounts of information quickly, ensuring that financial institutions have access to real-time data. This immediacy allows for more informed decision-making and a quicker response to regulatory changes.

Moreover, these systems are designed to adapt to the ever-changing landscape of financial regulations. With compliance requirements becoming increasingly complex, automated reporting systems can be updated to reflect new laws and standards. This adaptability is crucial for organizations that must navigate a labyrinth of regulations while maintaining their operational integrity.

To illustrate the impact of automated reporting systems, consider the following table that highlights key advantages:

| Advantage | Description |

|---|---|

| Time Efficiency | Reduces the time spent on data collection and reporting tasks, allowing teams to focus on strategic initiatives. |

| Enhanced Accuracy | Minimizes human error through automated data processing, resulting in more reliable reports. |

| Regulatory Adaptability | Quickly adjusts to new regulatory requirements, ensuring compliance without extensive manual intervention. |

| Cost Savings | Reduces operational costs by automating routine tasks and minimizing the need for extensive compliance teams. |

In addition to these advantages, automated reporting systems also foster a culture of transparency within financial institutions. By providing clear and accurate reports, organizations can build trust with stakeholders, including regulators, investors, and customers. This transparency is essential in an industry where trust is paramount.

However, it's important to recognize that the implementation of automated reporting systems does not come without challenges. Organizations must ensure that their AI systems are designed with data privacy and security in mind. As these systems handle sensitive financial data, safeguarding this information against breaches is crucial. Additionally, while AI can enhance reporting accuracy, it is vital to maintain a human oversight element to address any anomalies or unexpected outcomes.

In conclusion, automated reporting systems represent a significant advancement in the financial sector. By leveraging AI technology, financial institutions can not only improve their compliance processes but also enhance their overall operational efficiency. As we move forward, the integration of these systems will likely become a standard practice, paving the way for a more agile and responsive financial landscape.

- What are automated reporting systems? Automated reporting systems are AI-powered tools that streamline data collection and reporting processes in financial institutions, enhancing accuracy and compliance.

- How do these systems improve efficiency? They reduce the time spent on manual data entry and processing, allowing teams to focus on strategic decision-making.

- Are there any risks associated with automated reporting? Yes, while they enhance accuracy, it's essential to maintain human oversight to address any anomalies and ensure data security.

Ethical Considerations in AI

As we dive into the world of artificial intelligence in financial services, it's crucial to pause and reflect on the ethical implications that accompany this technological marvel. While AI holds the potential to revolutionize how we manage finances, it also raises significant concerns that cannot be overlooked. One of the primary issues is data privacy. With AI systems relying heavily on vast amounts of customer data to function effectively, the risk of sensitive information being mishandled or exposed is a pressing concern. Financial institutions must ensure that they are not only compliant with data protection regulations but also transparent with their customers about how their data is being used.

Another critical ethical consideration is algorithmic bias. AI systems learn from historical data, and if that data reflects existing biases—whether related to race, gender, or socioeconomic status—the algorithms may perpetuate these biases in their decision-making processes. This could lead to discriminatory practices in lending, insurance, and other financial services, ultimately harming individuals and communities. It's essential for financial organizations to actively work on identifying and mitigating these biases to foster a more equitable financial landscape.

Moreover, the transparency of AI decision-making processes is a vital aspect that needs addressing. Customers deserve to understand how decisions affecting their finances are made. If an AI system denies a loan application or suggests investment strategies, the reasoning behind these decisions should be clear and comprehensible. This transparency not only builds trust but also empowers consumers to make informed choices about their financial futures.

As we navigate these ethical waters, financial institutions must adopt a proactive stance. This involves implementing robust governance frameworks that prioritize ethical AI use. Regular audits of AI systems, training for staff on ethical considerations, and open dialogues with customers about AI's role in their financial lives are all steps toward fostering an ethical approach to AI in finance.

In summary, while the integration of AI in financial services offers numerous advantages, it is imperative to approach its implementation with a keen awareness of the ethical challenges it presents. By prioritizing data privacy, addressing algorithmic bias, and ensuring transparency, financial institutions can harness the power of AI responsibly and ethically.

- What are the main ethical concerns surrounding AI in finance?

Key concerns include data privacy, algorithmic bias, and the need for transparency in decision-making processes. - How can financial institutions mitigate algorithmic bias?

By regularly auditing AI systems and ensuring diverse data sets are used for training algorithms, institutions can work towards reducing bias. - Why is transparency important in AI decision-making?

Transparency helps build consumer trust and allows customers to understand the factors influencing financial decisions. - What steps can be taken to ensure data privacy?

Financial institutions should comply with data protection regulations and communicate clearly with customers about data usage.

Frequently Asked Questions

- What is the role of AI in enhancing customer experience in financial services?

AI plays a crucial role in transforming customer experience by analyzing vast amounts of customer data to provide personalized financial services. This means that financial institutions can offer tailored recommendations, improving engagement and satisfaction. Think of it as having a financial advisor who knows you personally, understanding your needs and preferences, and guiding you towards the best financial decisions.

- How does AI help in risk management and fraud detection?

AI enhances risk management and fraud detection by employing advanced algorithms and predictive analytics to identify potential risks and fraudulent activities. It’s like having a vigilant security system that continuously monitors your financial transactions, alerting you to any suspicious behavior before it escalates. This proactive approach helps financial institutions safeguard their assets and maintain trust with their customers.

- What are predictive analytics, and how do they benefit financial organizations?

Predictive analytics involves using AI to forecast market trends and assess risks. By analyzing historical data, financial organizations can make informed investment decisions, leading to better financial outcomes. Imagine being able to predict the weather before a big event; predictive analytics allows businesses to anticipate market changes and adapt their strategies accordingly.

- How does real-time monitoring contribute to risk management?

Real-time monitoring systems utilize AI to detect anomalies and respond promptly to emerging risks. This ensures that financial institutions can act swiftly to mitigate potential issues, rather than reacting after the fact. It’s like having a smoke detector that alerts you the moment it senses danger, allowing you to take action before a small problem becomes a disaster.

- In what ways does AI streamline operations in financial services?

AI streamlines operations by automating routine tasks, which reduces operational costs and frees up professionals to focus on strategic decision-making and customer relations. Think of it as having a personal assistant that handles all the mundane tasks, enabling you to concentrate on what really matters—growing your business and enhancing customer engagement.

- How does AI assist with regulatory compliance?

AI helps financial institutions monitor transactions and ensure adherence to complex regulations, minimizing human error. Automated systems can analyze data more accurately and efficiently than manual processes, making compliance reporting a breeze. It’s like having an expert compliance officer who never misses a detail, ensuring that everything is in line with regulations.

- What are the ethical considerations surrounding AI in financial services?

Ethical considerations include data privacy concerns, algorithmic bias, and the need for transparency in AI decision-making processes. As AI systems become more integrated into financial services, it’s essential to address these challenges to maintain consumer trust. Think of it as a balancing act—financial institutions must leverage AI's power while ensuring ethical standards are upheld to protect their customers.